Policy Update: Taxation & Representation

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! Kamala Harris’ Rise to the Top of the Ticket Renews Attention to Her Tax Policy Proposals: On July 21, President Joe Biden announced his withdrawal...

Saying It Out Loud, By Pat Soldano. July 2024.

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! By Patricia M. SoldanoPresidentFamily Enterprise USA Wealth Tax Talks Heat Up as Supreme Court Weighs In, New House Tax Teams Formed, and Senate Tax...

Family Office of Future Will ‘Look Very Different from Today,’ According to Expert Panel at Symposium

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! Family Office of Future Will ‘Look Very Different from Today,’ According to Expert Panel at 18th Annual Family Office Symposium Policy and Taxation...

Congressional Family Business Caucus Signs 49th House Member

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! The bi-partisan Congressional Family Business Caucus saw its 49th member sign on to its mission to listen and learn from America’s largest private...

New Membership Level Offered to Non-Family Businesses

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! Join Forces to Advocate for Family Businesses on Capitol Hill New Membership Offering Allows Non-Family Businesses to Attend Congressional Family...

Pathstone Webcast Replay: Family Vision and Values: The Starting Point of Estate Planning

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! In this webcast, Family Vision and Values: The Starting Point of Estate Planning, senior Pathstone executives Jim Coutré and Scott Weaver will share...

‘Next Gen’ Survey Highlights Lack of Communication as Concern in New Smith Family Business Initiative from Cornell

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! ‘Next Gen’ Survey Highlights Lack of Family Communication as Key Concern in New Smith Family Business Initiative from Cornell University Survey...

Stay Informed: Join Our Legislative Quarterly Update Webcast!

Gain exclusive insights on elections, IRS exams, and more from top experts and Members of Congress. Donate to Family Enterprise USA to get registered Now! About Brownstein Hyatt Farber SchreckBrownstein Hyatt Farber Schreck is a unique law firm. Walk into any of our...

[REGISTER TODAY] Protecting Wealth in Today’s Legislative Environment

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! Register Now for this July 16 Event: Starting at 2:30 PM Eastern Time “Protecting Wealth in Today’s Legislative Environment” Meet Our Speakers: Pat...

Evaluating Business Structures: The Pros And Cons

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! By Isaac Bradley, J.D., CPADirector of Financial PlanningHomrich Berg Family businesses often start small with simple business and tax structures....

New Podcasts Focus on Top Concerns Facing Family Office Clients

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! Family Office Exchange, Tamarind Learning Focus on Top Concerns Facing Family Office Clients in New Podcasts Pat Soldano, President, Policy and...

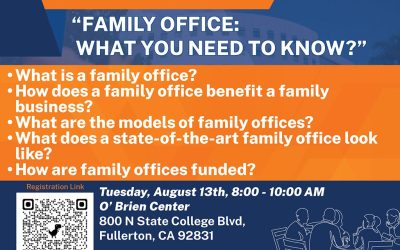

Family Office Workshop: What You Need To Know?

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! CSUF Family Business Center Workshop; “Family Office: What You Need To Know?” August 13, 2024 You will learn, “what is a family office”, the...

[ONLY 36 HOURS LEFT] Estate Planning Essentials: Begin with Family Vision and Values

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! Register Now for the July 10 Webcast: Starting at 12:00 PM Pacific Time “Family Vision and Values: The Starting Point of Estate Planning” Why attend?...

Federal Court Partially Halts Noncompete Rule

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! On July 3, 2024, United States District Court Judge Ada Brown ruled against the Federal Trade Commission (FTC) and issued a preliminary injunction...

U.S. Family Businesses Grow Despite Challenges of Inflation, Labor, and Taxes Says Latest Family Business Survey

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! U.S. Family Businesses Grow Despite Challenges of Inflation, Labor, and Taxes Says Family Enterprise USA’s Latest Family Business Survey Survey...

Weekly Washington Update: Policy Highlights from the First 2024 Presidential Debate

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! 2025 Outlook—Democrats Setting Battle Lines as 2024 Elections Loom: Though much of the attention on the expiration of key tax provisions of the Tax...

Trade Association Members

We are proud to welcome these trade associations that have joined our mission to advocate for family-owned businesses across the nation. Our Valued Trade Associations Members Discover the Benefits of Membership Join Family Enterprise USA to unlock a wealth of...

WEBCAST ALERT: Integrating Family Vision into Your Estate Planning

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! Register Now for the July 10 Webcast: Starting at 12:00 PM Pacific Time “Family Vision and Values: The Starting Point of Estate Planning” Why attend?...

Family Offices Need ‘Wealth 3.0 Mindset’ to Succeed in Future, Says Ultra High Net Worth Institute Founder

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! Family Offices Need ‘Wealth 3.0 Mindset’ to Succeed in Future, Says Ultra High Net Worth Institute Founder Steve Prostano, in New Policy and Taxation...

Handing Over the Keys—The Challenges of Reaching Gen Z

Stand up and be heard! Contact your lawmakers in Congress to advocate for positive change. Act now by clicking here! By By Linda MackFounder and PresidentMack International In a recent FEUSA podcast Pat Soldano was joined by Dr. Frank Luntz, communications expert and...

![[ONLY 36 HOURS LEFT] Estate Planning Essentials: Begin with Family Vision and Values](https://patsoldano.com/wp-content/uploads/2024/07/Zoom-Speakers-Jim-Coutre.jpg)