by Pat Soldano | Jan 9, 2025 | Estate Tax

Your Perspective Matters: Complete Our Family Business Survey Take 5 minutes to share your insights and gain access to our exclusive 2025 webcast. Newport Beach Real Estate Investment Firm Helps to Support Health of Family Businesses Buchanan Street Partners, a real...

by Pat Soldano | Jan 8, 2025 | Estate Tax

Join Us in Shaping the Future of Family Businesses First Congressional Family Business Caucus Meeting March 11, 2025 Be part of a pivotal gathering where family business leaders and policymakers unite to discuss and advocate for the growth and sustainability of...

by Pat Soldano | Jan 8, 2025 | Estate Tax

Register Now for this January 15 Webcast: Starting at 12:00 PM Pacific Time “The Cost of Timing the Market: Insights for Smarter Investment Strategies” Discover the critical factors influencing investment success in this insightful webcast. We will delve into the...

by Pat Soldano | Jan 4, 2025 | Estate Tax

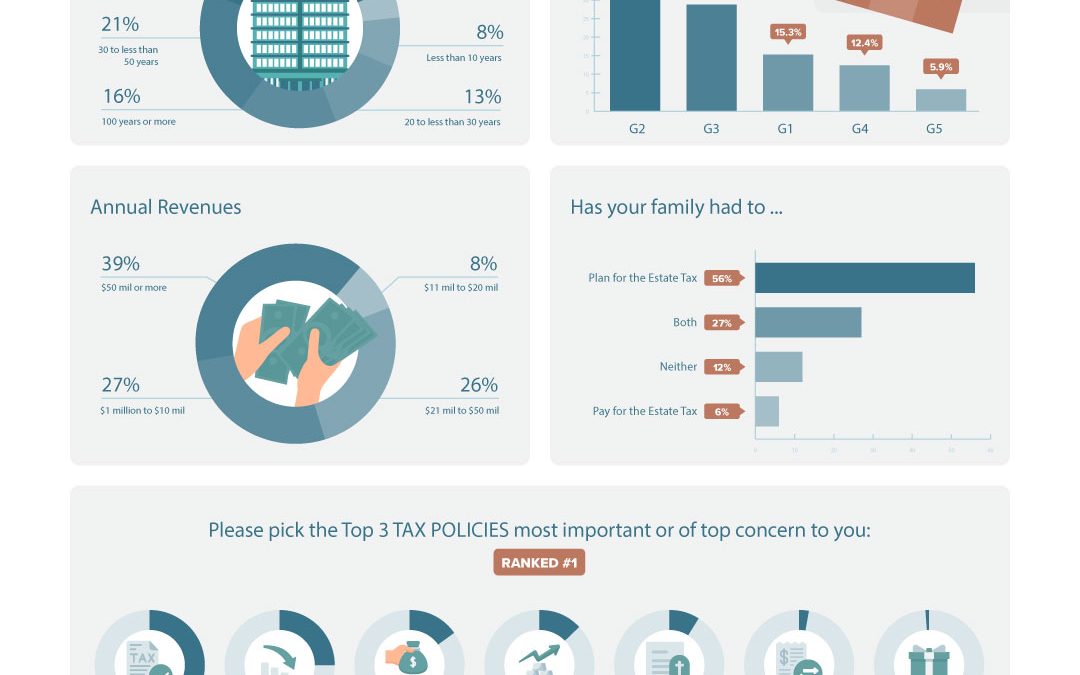

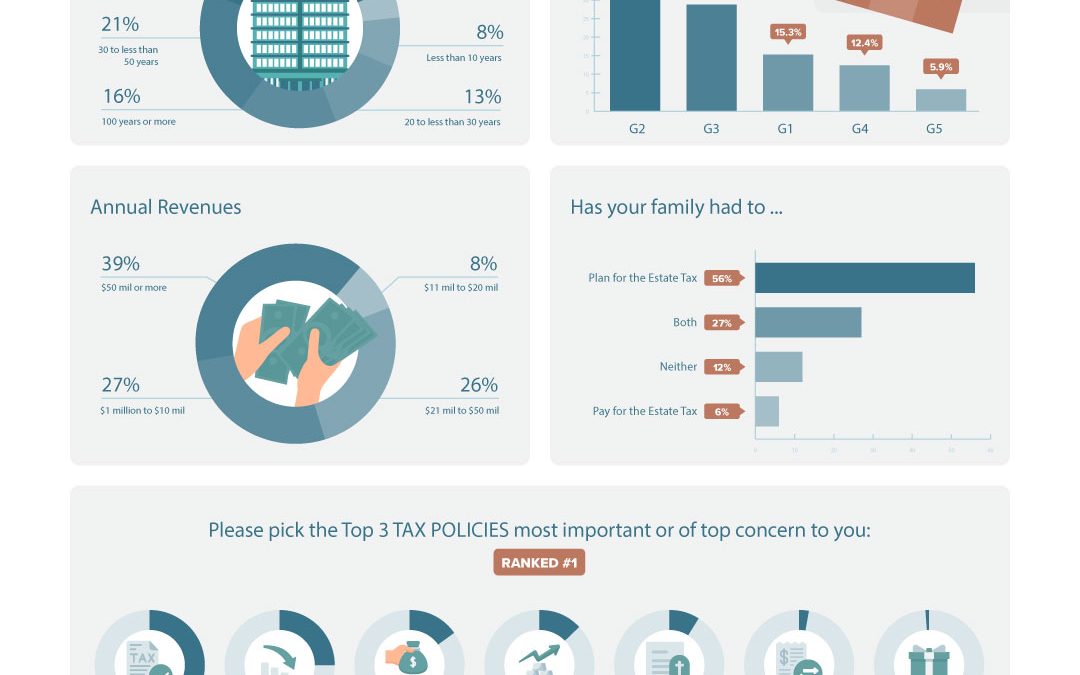

Your Perspective Matters: Complete Our Family Business Survey Take 5 minutes to share your insights and gain access to our exclusive 2025 webcast. New Family Enterprise USA Pulse Survey Shows Top 3 Tax Policies Family Businesses are Concerned about Going in 2025 No...

by Pat Soldano | Dec 28, 2024 | Estate Tax

Your Perspective Matters: Complete Our Family Business Survey Take 5 minutes to share your insights and gain access to our exclusive 2025 webcast. By Patricia M. SoldanoPresidentFamily Enterprise USA A Year of Accomplishments Means More Hard Work Ahead in 2025 This...

by Pat Soldano | Dec 28, 2024 | Estate Tax

Your Perspective Matters: Complete Our Family Business Survey Take 5 minutes to share your insights and gain access to our exclusive 2025 webcast. Key Information: On Thursday, December 26, the Fifth Circuit Court of Appeals restored a nationwide injunction suspending...