Thank you to BNY Mellon Wealth Management for this report.

What are some of the benefits and risks in the election of the 83(b) approach?

Private and public companies grant deferred equity awards as a form of compensation, which can be delivered as restricted stock, performance share units (PSUs) or restricted stock units (RSUs). When a restricted stock award is granted, the recipient must decide if they want to make an 83(b) tax election. In this paper, we will describe some of the pros and cons of electing 83(b) on the grant of a restricted stock award.

RESTRICTED STOCK AWARDS

As described above, restricted stock awards are a form of compensation for services. An employer grants stock to an employee, and the employee’s rights to the shares are limited until they vest and cease to be subject to restrictions. The vesting can be graded over time: for example, 25% of shares vest each year for four years, or Cliff vesting, which is when all shares vest in the third or fourth year from when they are granted. There are also performance share awards (PSUs), under which the number of shares granted may increase or decrease depending on a company’s predetermined performance metric. As for dividends, if the underlying stock pays a dividend, it depends on the plan whether the dividends accrue or pay out during the term of the award.

With restricted stock, there is a substantial risk of forfeiture, which is why the grant is not subject to income tax when first awarded. For example, stock is forfeited if the recipient leaves the company, the company dissolves, or it goes bankrupt. While there is no initial tax impact on grant, once the stock vests, the award will be fully subject to all payroll taxes and included in the recipient’s W-2. The holding period begins on the date of vesting, and if the stock is held for greater than one year from that date, any subsequent gain will be treated as long-term capital gains.

TAX RATES

In 2022, the federal tax rate on ordinary wage income is 37% at the highest rate. In addition, there are various payroll taxes like the 1.45% Medicare tax and 0.90% above $200,000. The highest long-term capital gains rate is 23.8%. State income and other payroll taxes will also apply. But the roughly 15% differential between ordinary income and capital gains tax rates is why an 83(b) election can be an important tax planning tool.

THE 83(B) ELECTION

Recipients of restricted stock are eligible to make a special 83(b) tax election within 30 days of the grant of a restricted stock award. Making an 83(b) election results in ordinary income equal to the difference between the Fair Market Value (FMV) of the stock at the time of grant minus the amount paid for the shares (if any). Depending on the value at that time, as well as what is paid for the shares, this ordinary income could be significant, it could be immaterial, or it could be zero. However, by making an 83(b) election, any subsequent gain would be considered a capital gain, and it could be a long-term capital gain if held for over a year from the grant date. An 83(b) election may be recommended if it is anticipated that the value of the restricted stock award will appreciate significantly. But if the value drops significantly, the award recipient would have to pay tax on income they ultimately never received.

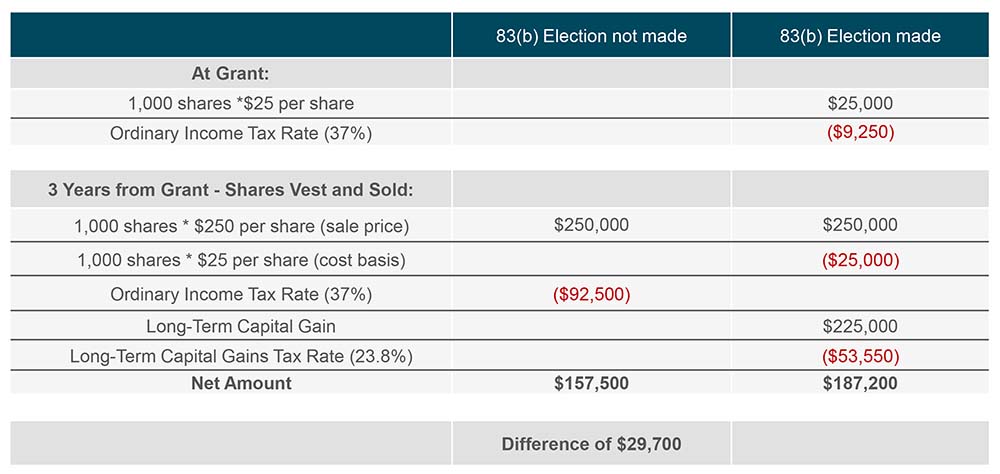

Exhibit 1:

Assume the Chief Information Officer (CIO) of ABC Inc. is granted 1,000 shares of restricted stock. At the time of the grant, the share price is $25 and the CIO receives the shares at no cost. After three years of service, the restrictions lapse and the stock vests. If the CIO makes an 83(b) election within 30 days from the grant date, they recognize $25,000 of ordinary income, which is taxed at an ordinary income tax Rate of 37% and payroll tax rate of 2.35%, or $9,838 total tax. Three years from the grant date, when the stock vests and restrictions lapse, the CIO sells 1,000 shares for $250 per share, or $250,000. The basis was $25,000, so the net is a long-term capital gain of $225,000, which is taxed at 23.8%, or $53,550, at the time of the sale. In total, the CIO ends up netting $186,612. If the 83(b) election had not been made, by the time the stock vested and restrictions lapsed, the CIO would have recognized ordinary income of $250,000, which would be taxed at an ordinary income tax rate of 37% and payroll tax rate of 2.35%, or $98,375, netting a total of $151,625.

By making the 83(b) election, the CIO increased the overall net amount received by an additional $34,987. Alternatively, if the 83(b) election was made and ABC Inc. declined to zero value on the vesting date when restrictions lapsed, or if the CIO left the company before said date, they would be out the $9,838 of tax paid.

REASONS TO CONSIDER 83(B) ELECTION, OR NOT:

You might consider it if you…

- Have a strong belief the stock will appreciate

- Have the liquidity to pay the tax on income not received

- Expect to have continued employment through the vesting period

You might not consider it if you…

- Will experience a loss of investment opportunity for the funds used for taxes

- Expect the stock price to depreciate

- Will potentially move to another company or be terminated

- Cannot tolerate possible tax legislation risk

DECISION MAKING PROCESS

Since the 83(b) election requires the payment of taxes upfront, calculate the amount of upfront cash needed and consider alternative uses for the cash. For example:

- Buy more company stock in the open market

- Invest in a diversified portfolio

- Invest in alternative investments such as private equity

The following considerations and decisions should be reviewed:

- Future tax rates and risk of legislative changes

- Expected return of the company stock, diversified portfolio or alternative investment

- Are all the alternative options mentioned above suitable from a risk tolerance standpoint

Based on the assumptions made, calculate the after-tax expected return in all scenarios when the stock vests. 83(b) election should be considered if the after-tax return exceeds other options.

HOW TO ELECT

The IRS must be notified of the 83(b) election within 30 days of the grant; the election cannot be made after that period. Keep in mind that the decision is irrevocable. In addition, a copy of the election must be sent to the employer and should be attached to the employee’s income tax return for the year the election was made.

CONCLUSION

An 83(b) election can be a significant tax planning tool, available within a short 30-day window from the date an equity award is granted. Recipients should consider the election in consultation with tax and legal professionals, and their financial advisors.

About BNY Mellon Wealth Management

For more than two centuries, BNY Mellon Wealth Management has helped families build, manage and preserve their wealth. Our specialized teams have the tools, knowledge and experience to develop comprehensive solutions for our business owner clients that address each client’s personal financial objectives and family dynamics, as well as issues specific to his or her business. For business owners considering a family office, our dedicated Family Office team brings more than 50 years of experience providing solutions and strategic insights to help family offices grow and preserve wealth across generations. For more information, visit www.bnymellonwealth.com or follow us on Twitter @BNYMellonWealth.

Family Enterprise USA advocates for American Family business. We help family businesses communicate their challenges and contributions to American economic freedom to Legislators. We represent all American family businesses; not just specific industries and provide research to enhance the opportunity for success. We help family businesses continue to establish their unique business legacy. Family Enterprise USA is a 501(c)(3) non-profit organization.. Family foundations can donate.

We hope you’ve enjoyed this article. While you’re here, we have a small favor to ask…

As we prepare for what promises to be a pivotal year for America, we’re asking you to consider becoming a member.

The need for fact-based reporting of issues important to multi generational businesses and protecting a lifetime of savings has never been greater. Now more than ever, multi generational businesses and family businesses are under fire. That’s why FEUSA is passionately working to increase the awareness of issues important to generationally-owned family businesses built on hard work, while continuing to strengthen our presence on Capitol Hill.

@FamilyEnterpriseUSA @PolicyAndTaxationGroup @DitchTheEstateTax #FamilyBusiness #Business #SmallBiz #EstateTax #Deathtax #CapitalGainsTax #StepUpInBasis #Taxes #gifttax #Generationskippingtax #InheritanceTax #repealestatetax #promotefamilybusinesses #taxLegislation #AdvocatingForFamilyBusinesses #incometax #Generationallyowned #Multigenerationalbusiness