Deprecated: strtolower(): Passing null to parameter #1 ($string) of type string is deprecated in /home/patsoldano/public_html/wp-content/plugins/autoblog/autoblogincludes/addons/originallinkinpopup.php on line 68

Deprecated: strtolower(): Passing null to parameter #1 ($string) of type string is deprecated in /home/patsoldano/public_html/wp-content/plugins/autoblog/autoblogincludes/addons/originallinkinpopup.php on line 68

Deprecated: strtolower(): Passing null to parameter #1 ($string) of type string is deprecated in /home/patsoldano/public_html/wp-content/plugins/autoblog/autoblogincludes/addons/originallinkinpopup.php on line 68

Deprecated: strtolower(): Passing null to parameter #1 ($string) of type string is deprecated in /home/patsoldano/public_html/wp-content/plugins/autoblog/autoblogincludes/addons/originallinkinpopup.php on line 68

Tax, Labor Issues Top Concerns of America’s Private Largest Employer, Family Businesses, Says New 2023 Family Business Survey

Just Released Family Enterprise USA Annual Family Business Survey 2023

Also Cites Supply Chain Issues, Inflation Damaging Business

Income taxes and labor worry are the top issues America’s family businesses point to when looking at this year’s economic hurdles, according to the new Family Enterprise USA Family Business Survey 2023 released today.

The annual survey measures the pulse of family-owned businesses, America’s largest private employer, and found the biggest worry resided in the country’s tax policies, with 50 percent of respondents saying high personal income taxes were the number one concern, up from 45 percent a year ago.

Another primary concern among family businesses was finding, training, and keeping employees, with 31 percent of family businesses and family offices saying this was of critical concern. Shifting “market conditions” were also a key worry, with 30 percent of respondents citing it as a main worry for the coming year.

The Family Enterprise USA Annual Family Business Survey 2023 was conducted in the first two months of 2023. The respondents were 571 family businesses or family business offices from across the country. The study’s main sponsors are Squire Patton Boggs and Brownstein, both leading law and lobby firms advocating for family businesses.

The survey assessed a cross section of America’s multi-generational family-owned industries that contribute $7.7 trillion annually to the U.S. gross domestic product. Family businesses are the largest private employers in the country, accounting for 83.3 million jobs, or 59 percent of the country’s private workforce, according to research.

Despite these concerns, these multi-generational family businesses, 74 percent of which have been in business for 30 years or more , 65 percent expect to grow in 2023 and 71 percent saw their business increase in 2022. Nearly, 40 percent of the respondents have revenues of $21 million or more, according to the survey.

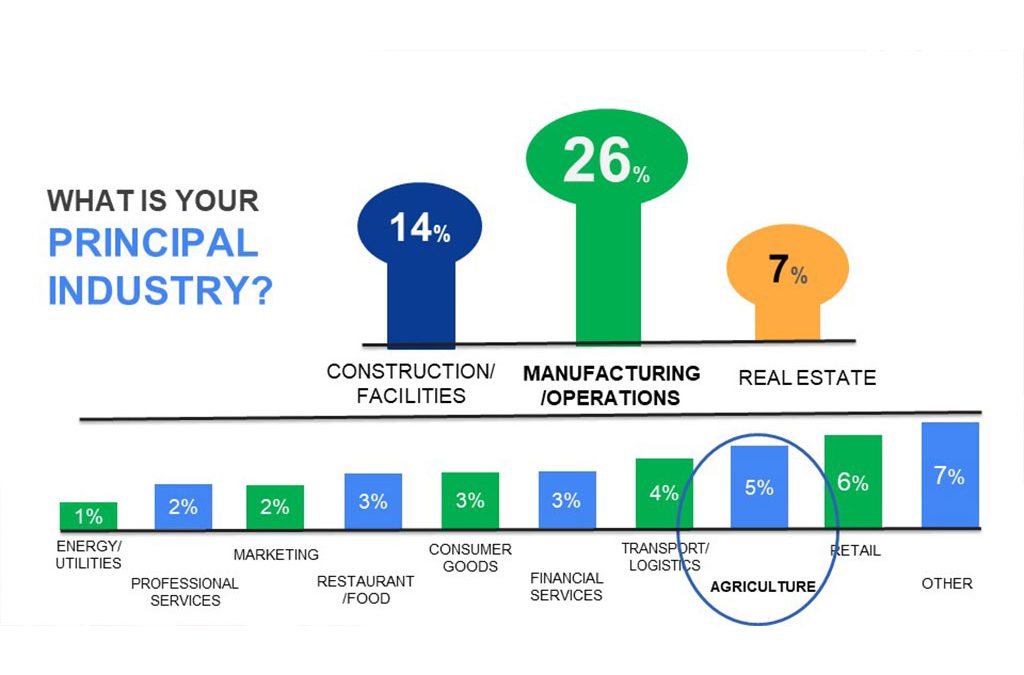

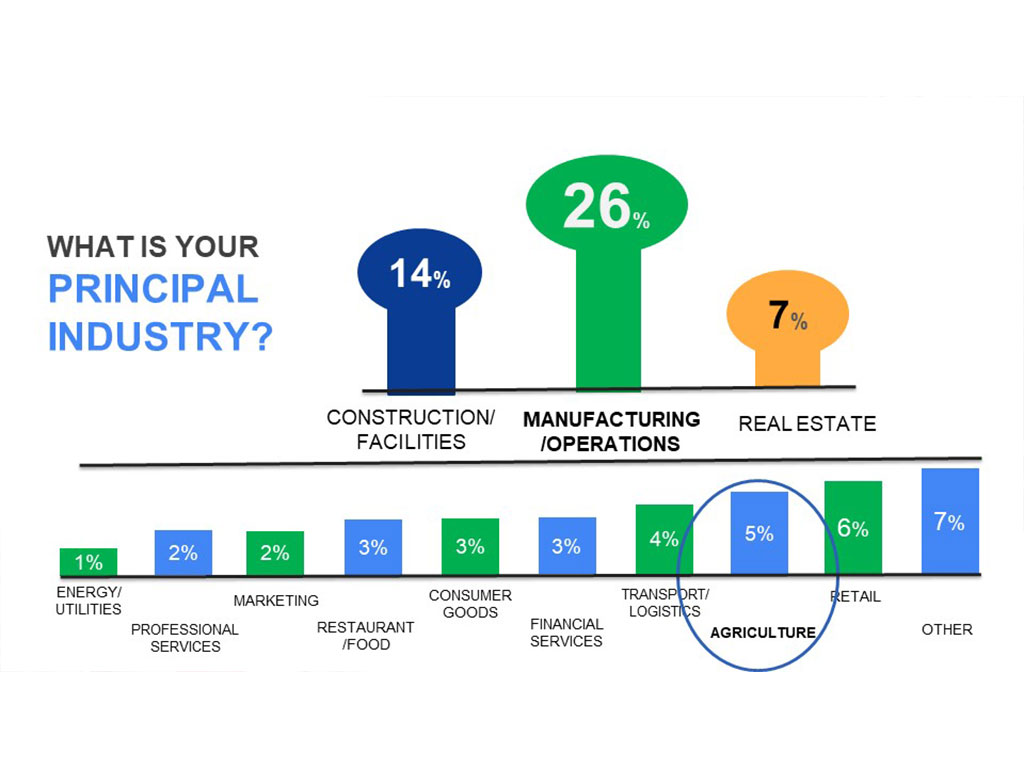

The top breakdown of family business industries were 26 percent in manufacturing , 14 percent in construction/facilities, and 7 percent in real estate. Agricultural businesses made up 5 percent of respondents.

“This year’s survey shows once again the resiliency of our country’s family businesses,” said Pat Soldano, President of Family Enterprise USA and the Policy Taxation Group, both non-partisan organizations advocating for family enterprises of all sizes, and organizers of the annual study. “This year’s survey showed again that family businesses keep jobs, add jobs, pay better than average wages, and give back to their communities, all of which are strong arguments to keep our family businesses thriving.”

The survey found 91 percent of family businesses said they kept jobs and 61 percent added jobs during a high-inflationary period. Only 9 percent of family business respondents lost jobs, the survey found. Some 46 percent said they pay “above average” wages and benefits. And 72 percent say they have “generational employees,” that is, employees working for family businesses for multiple generations. In addition, the survey found 82 percent donated funds to local charities or local chapters of national charities.

Economic and Tax Issues

The specter of increased inflation and supply chain bottlenecks both registered as high concerns among survey respondents, the study showed.

Nearly three-quarters of family business (74 percent) said inflation “hurt profitability” and 86 percent said supply chain disruptions were still top of mind as a critical issue, the survey found.

The top economic priority family businesses mentioned in the survey revolved around taxes.

Some 19 percent of the respondents said the “most important” tax issue was to reduce personal income taxes, while 18 percent said reducing the Estate Tax, or The Death Tax , was a priority. When it came to changing the Estate Tax provision, 33 percent thought it important to keep it “as is,” while 24 percent said this a year ago.

“Family businesses are a driver of the US economy, and they can adapt easier than larger corporations,” said Soldano. “Yet they are often at a disadvantage tax wise and are often penalized for not being set up as a corporate entity.”

When it comes to passing down the family business to the next generation of family operators, 86 percent say it is important to keep the business all in the family to “create and sustain jobs.” The study showed that 79 percent believed the business important because it is part of the “family legacy.”

The study revealed 66 percent have “passed on ownership” to the next generation, a 29 percent increase from 51 percent saying the same thing in last year’s study.

We hope you’ve enjoyed this article. While you’re here, we have a small favor to ask…

As we prepare for what promises to be a pivotal year for America, we’re asking you to consider becoming a member.

The need for fact-based reporting of issues important to multi generational businesses and protecting a lifetime of savings has never been greater. Now more than ever, multi generational businesses and family businesses are under fire. That’s why Family Enterprise USA is passionately working to increase the awareness of issues important to generationally-owned family businesses built on hard work, while continuing to strengthen our presence on Capitol Hill. The issues we fight for or against with Congress in Washington DC include high income tax rates, possible elimination of valuation discounts, increase in capital gains tax, enactment of a wealth tax, and the continued burden of the gift tax, estate tax and generation skipping tax.

Family Enterprise USA promotes family business and job creation, growth, and sustainability by advocating for family businesses, their lifetime of savings, and the issues they face running their businesses every day. Some of the issues we fight for or against with Congress in Washington DC are high Income tax rates, possible elimination of valuation discounts, increase in capital gains tax, enactment of a wealth tax, and the continued burden of the gift, estate and generation skipping taxes. Family Enterprise USA represents and celebrates all sizes and industries of family businesses and multi-generational employers.

Family Enterprise USA (FEUSA) is a 501(c)(3) non-profit organization. Family foundations can donate.

#incometax #taxseason #federaltaxpolicy #taxation #EstateTax #Deathtax #wealthtax #taxLegislation #CongressionalCaucus #CapitalGainsTax #incometaxrates #incometaxseason #taxrefund #taxreturn #incometaxreturn #gifttax #Generationskippingtax #InheritanceTax #repealestatetax #FamilyBusiness #promotefamilybusinesses #familyowned #supportlocalbusiness #womeninbusiness #AdvocatingForFamilyBusinesses #Generationallyowned #Multigenerationalbusiness @FamilyEnterpriseUSA @PolicyAndTaxationGroup @DitchTheEstateTax #FamilyEnterpriseUSA #PolicyAndTaxationGroup #DitchTheEstateTax